Discover the best family-friendly Halloween events & activities in Ireland in 2025. From pumpkin patches to haunted houses, plan a fun Halloween adventure for your family.

Discover the best family-friendly Halloween events & activities in Ireland in 2025. From pumpkin patches to haunted houses, plan a fun Halloween adventure for your family.

Discover our guide on how to clean fabric or leather car seats at home easily so that you can save money and maintain the resale value of your car here.

Coolant is an essential part of keeping your vehicle running smoothly. Learn what car coolant is, how it’s used, and when to seek professional help with it.

Driving in Ireland means dealing with foggy windows year-round. Learn how to manage foggy windows effectively and prevent them from happening here.

Discovering that your car battery is dead can be frustrating. Learn how to safely charge your car battery at home so you can get back on the road here.

Personal accidents can occur anywhere, which is why it’s important to have coverage to keep you safe. Learn how personal accident insurance works with AIG.

Ready for the NCT? Follow AIG's handy checklist on everything you should bring and do before your NCT for a stress-free testing experience.

Wondering what a vehicle registration certificate or logbook is and why you need one? Whether you're a new or experienced driver, check out our guide today.

New to driving in Ireland or need to study up for your NCT? Discover our handy guide explaining a wide variety of Irish road signs and road markings here.

Renewing your car insurance at the right time is essential to reducing your insurance premiums. Discover how to renew your car insurance with AIG here.

Whether you're an experienced or young driver, knowing when tyres should be replaced is essential for keeping your car in great condition. Learn more here.

Learn how to jump start a flat battery using jump leads with our comprehensive guide, including tips on safety, connecting the leads, and when to call for help.

Time to renew your driver's licence? While it may seem like a hassle, it's very straightforward. Learn how to renew your licence quickly and easily here.

Learn how to parallel park with ease using our stress-free parallel parking guide. We break it down step by step and give you tips for practicing here.

In this article we cover 6 simple steps to help you make an informed decision and switch car insurance seamlessly. Find the right coverage for you with AIG today!

Celebrate Easter 2025 with our guide to family-friendly events in Ireland! From egg hunts to farm experiences, explore weekend events in Dublin, Kildare, Cork, and more!

Discover family-friendly St. Patrick's Day events in Ireland for 2025, from vibrant parades to historic celebrations across the provinces of Leinster, Munster, Connacht & Ulster.

Navigating Irish roads? Get essential tips on road conditions, parking, tolls, fuel, emergencies & more. Drive safely and confidently with our guide!

Driving in Ireland? This comprehensive guide covers essential rules, speed limits, drink driving laws, licensing, penalty points, and more. Check it out!

Filing a car insurance claim can be stressful. Our 6-step guide simplifies the process, providing advice every step of the way. Get the support you need from AIG.

Learn about the dangers of distracted driving in Ireland, common distractions, and how to avoid them. Stay safe and legal with these essential tips from AIG

Drive safely and responsibly around cyclists. This guide covers Irish road rules, cyclist behaviour, safe overtaking, and what to do if a collision occurs.

Make long car journeys with children easier! Get practical tips for keeping kids entertained, comfortable, and safe on long car drives.

Discover the true cost of running a car in Ireland. Understanding these costs can help you budget effectively and identify areas for potential savings. Read now!

Everything you need to know about buying a second-hand car in Ireland. From budgeting and finding the right car to negotiating and legal requirements.

Learn how to confidently drive on motorways with our beginner's guide. From merging and overtaking to handling breakdowns, we cover it all. Drive safely and stress-free!

Discover the key factors influencing your car insurance premium in Ireland. AIG's guide helps you understand and potentially lower your rates. Get a quote today!

Whether you are looking for great value car, home or travel insurance, or you need to make a claim, you can find our 2024 Christmas opening hours here.

Explore the best-selling cars in Ireland in 2024. From SUVs to hybrids, get insights into market trends, year-on-year sales data, and predictions for 2025. Check it out!

Discover the best Christmas markets, Santa experiences, and festive activities across Ireland! Explore events in Leinster, Munster, Connacht & Ulster.

Confused about comprehensive car insurance? We break down the coverage, benefits, and exclusions in this easy-to-understand guide. Get a quote from AIG today.

Learn how to protect your car from theft with our comprehensive guide. Get tips on prevention, security measures, and what to do if your car is stolen.

Learn how to wash your car at home like a pro with our step-by-step guide. From supplies to techniques, get a sparkling clean car every time.

Equip your teen with safe driving skills! Learn how to teach responsible driving habits, choose the right car, and understand insurance options for young drivers.

Experience the magic of Ireland on these 7 breathtaking scenic drives. From dramatic cliffs to charming villages, prepare to be captivated by the Emerald Isle's beauty!

Planning a road trip with your furry friend? Discover essential tips for traveling with your dog in the car, from preparing for the trip to ensuring their comfort & safety.

Planning a European road trip? This guide covers insurance, rules, & tips for a smooth & enjoyable road trip. Start planning your adventure.

Safe driving is everyone's responsibility. By understanding and actively working to prevent the most common causes of car accidents, we can make our roads safer for all users.

Explore our list with the top 10 best cars for first-time drivers in Ireland. Our guide considers safety, affordability, and reliability to help you choose wisely.

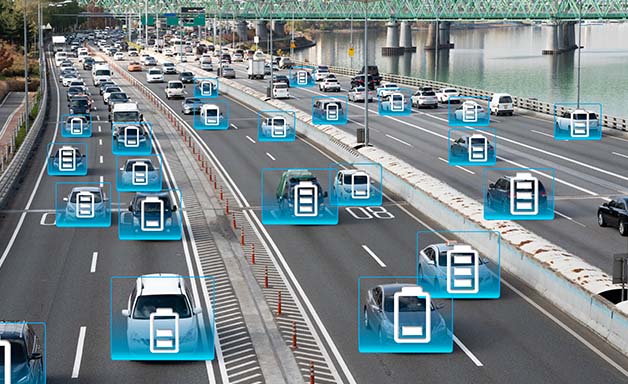

Learn about black box car insurance and how telematics technology can promote safer driving habits and potentially lower insurance costs.

Are you a new driver in Ireland looking to buy your first car? Our comprehensive guide outlines the steps to make your car-buying journey as smooth as possible. Check it out!

Searching for car insurance but struggling with the terminology? Our handy can insurance terminology guide will help you to cut through the jargon.

Prepare for diverse winter conditions with our comprehensive guide on winter driving techniques. Learn tips for driving in fog, high winds, ice, snow, and heavy rain.

Driving a new car can be exciting yet daunting. Our article provides practical tips on how to get used to a new car, ensuring your journey is smooth, safe, and satisfying.

Discover the top trends shaping the automotive industry in 2024, including electric car shift, autonomous driving progress, evolving ownership models and more.

Ensure your car is equipped to handle the cold weather with these 8 essential tips for winter car care. From battery checks to emergency kits, stay safe on the road this winter.

Timing is Key: Read our comprehensive guide to discover optimal buying periods to buy a car in Ireland. From registration plates to seasonal promotions, we cover it all.

Learn about car safety features and technology available and make safer choices on the road, as they contribute to overall road safety by preventing accidents.

Uncover essential tips for hiring a car abroad and navigating excess insurance. Enjoy a hassle-free car rental experience on your next overseas adventure!

Get into the Halloween spirit and spend some quality time with your child creating spooky crafts, delicious treats and more with our list of 10 activities.

Vulnerable road users are those who are exposed to greater risk when navigating our roads. Read our guide and know how you can do your bit to protect road users.

Discover the differences between third-party fire & theft and comprehensive car insurance. Get clarity on coverage, benefits, and find the right insurance option for your needs. Check it out!

Learn about Irish child car safety rules, including the legal requirements for seating children in the front seat, types of child car seats, & tips to avoid common mistakes.

Understand what factors affect a car's resale value the most and apply these strategies and tips to keep your car in top condition and retain its value. Check it out!

Discover valuable techniques to stay awake behind the wheel and combat driver fatigue on the road. Read our effective strategies and ensure your safety while driving.

Struggling with the decision of buying a new or old car? Read our valuable insights to help determine which option best suits your needs before making the big purchase.

Seeking ways to save money on overall car expenses? Follow these simple tips on how can fuel efficiency be improved and you should be filling up less often.

Are you a commuter looking for a car that can handle the daily grind? Check the best cars for commuters that are efficient, comfortable, and well-suited for different driving conditions.

Whether you’re a new driver or an experienced one, it's always important to know the basics of keeping your car in good repair. We’ve put together this basic car maintenance check list which we’ve also illustrated with a handy car repair and maintenance infographic.

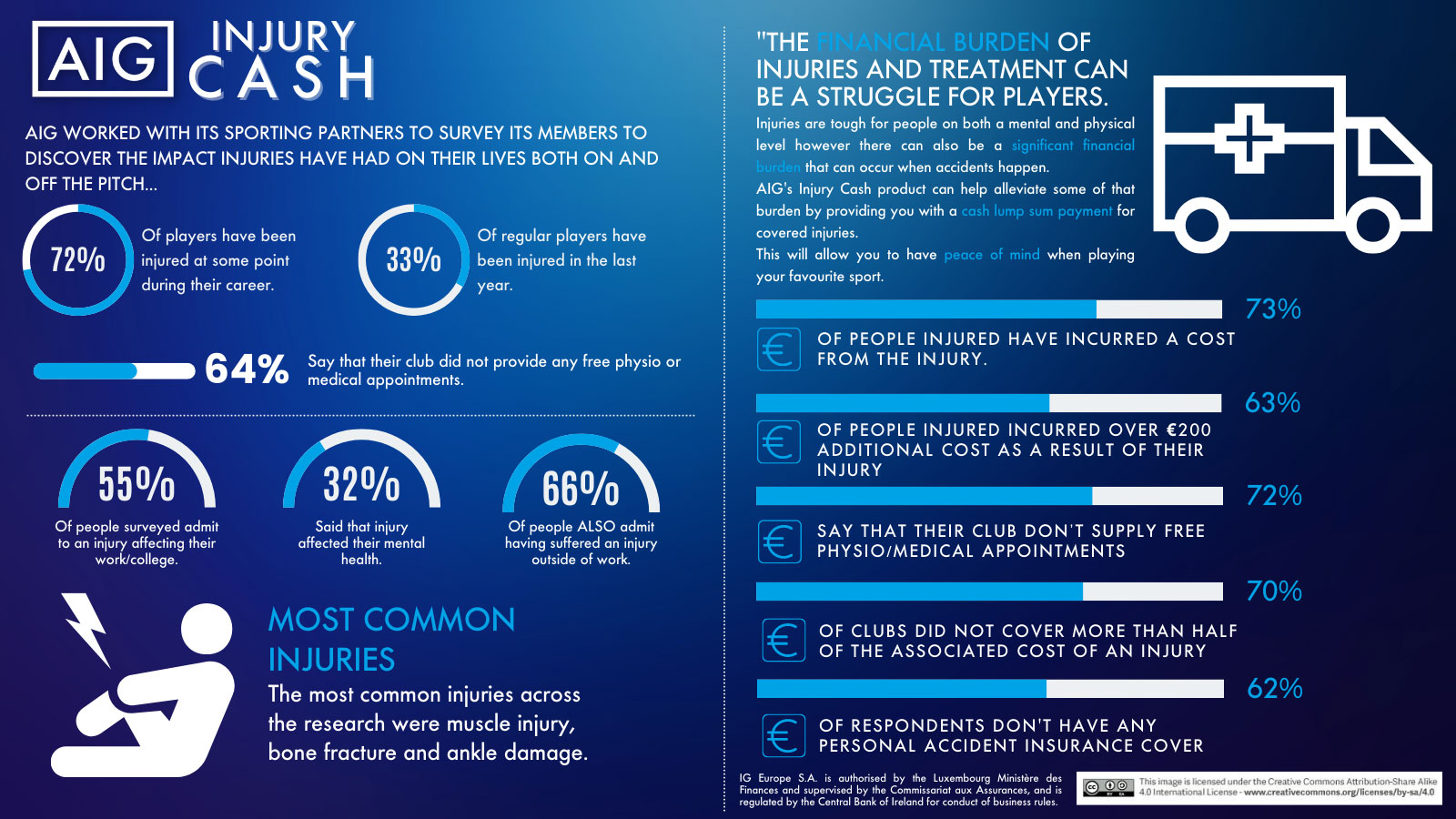

New research has found that 72% of Irish people who regularly participate in sport have sustained an injury while playing, with 73% of those injured incurring a significant financial cost as a result.

Moving out on your own for the first time is a big step. We can shine a light on what you need to do to ensure your first-time renting goes smoothly. Read our guide!

Learn essential tips to handle roadside emergencies and ensure safe travels. Whether you're involved in an accident, or your car simply dies, our guide can help.

Learn about AIG Breakdown Assistance and other useful Car Insurance Extras. We provide 24 hour assistance, 7 days a week, roadside assistance, windscreen cover and more.

No one plans to be involved in an accident on the road, but it can happen. Our guide takes you through the steps required when you’ve been involved in a car accident.

To help ensure you buy a car that isn't going to break down on you and that won't cost you a fortune to run, here are some tips to use when buying a new car. Read now!

The automotive industry is finally re-emerging after a tough time. In this article we outline the top trends affecting the motor industry in 2022. Read now!

Prepping for your theory test can seem daunting – there’s a lot to cover. Use our helpful guide to prepare for your Driver Theory Test and pass the first time.

Ready to sit your driving test? Check out our tips for passing and discover the top reasons why people fail. Be prepared with AIG.

Time to apply for your first full licence or learner permit? Or is it time to renew? Avoid hassle and multiple trips to the NDLS centre with our document checklist.

We find out if e-cars are cheaper to insure and give you a checklist of things to consider when insuring an electric car. Learn more now.

Looking for a cheaper car insurance quote? Find out why you may be struggling to find one and how AIG Car Insurance could help.

Buying an electric car has major benefits: it’s better for the environment, your health and your wallet! Learn about the grants and discounts available.

Use our interactive Family Time Map to find out what’s on in County Galway. Family Activities? Restaurants? Playgrounds? We’ve got it all covered.

Use our interactive Family Time Map to find out what’s on in County Cork. Family Activities? Restaurants? Playgrounds? We’ve got it all covered.

Use our interactive Family Time Map to find out what’s on in South County Dublin. Activities? Restaurants? Playgrounds? We’ve got it all covered.

Use our interactive Family Time Map to find out what’s on in North County Dublin. Activities? Restaurants? Playgrounds? We’ve got it all covered.

Whether you need learner driver insurance for your own car or insurance for learner drivers on a parents car, we’ve the first time drivers insurance for you.

Your car’s windscreen is one of the most important parts of your car to keep clean and safe. Learn essential car glass care tips here.

Discover 5 scenic hikes in Ireland with suitable options for seasoned hikers and beginners. Don’t forget your camera for those views.

Few people alive today will have seen Jimmy Bruen in his prime. One of Ireland’s greatest golfers, the 100th anniversary of his birth falls on Friday, May 8.

Running can be for everyone. Find out everything you need to get started and stay motivated on your running journey.

As the COVID-19 pandemic evolves, AIG remains focused on the safety of our colleagues and those around us while continuing to serve our customers.

Planning a staycation with your family? Discover our recommendations for weekend breaks for families in Ireland here. There’s no place like home.

New to driving? Check out these 10 tips to get you ready for your full test and hopefully pass the first time around.

Thinking of going electric or considering a hybrid car? Learn all about the different pros and cons of each and choose the right car for you.

Want to stretch your legs with your family in the west? Check out our guide to 10 family friendly walks in Galway for children of all ages.

AIG, the Official Insurance Partner to the LGFA revealed our exclusive car and home insurance deals for LGFA members and their families.

Save money, avoid fees and have a stress-free holiday: Discover the reasons why Car Hire Excess Insurance should be at the top your holiday packing list.

Struggling to hit the ball straight down the fairway? Or maybe it flies high but not far enough. Your swing might be the problem. We have some tips to help.

Feeling left out when your colleagues and friends hit the fairways? Check out our beginner’s guide golf with tips to get started and some fun games to try.

Just started playing golf? Or playing for a while and looking to improve your handicap? We have some tips to help that you may not have thought of.

Feel stressed behind the wheel? Check out our advanced driving tips from an expert and see how you can improve.

Bringing the car to France? Or hiring a car abroad? Check out our tips for driving on the other side of the road today.

Mountain hikes, cliff walks, and city strolls. Check out one of these 10 family friendly walks for easy walks in Dublin. Pack up a picnic and hit the trails.

Two intercounty stars talk training, motivation and GAA goals in the latest instalments of #DublinOurTeam. Not to be missed!

Varying your stretches will help to bring maximum benefit to your body so AIG have created this handy guide to stretches you should be doing.

Need help cycling in the city? Follow these steps by AIG to stay safe on the roads when cycling in an urban environment.